With sales of $500, your contribution margin on the sale is $300.

If on an invoice you sold two coats at a retail price of $250 each, and they cost you $100 to buy from your supplier, you cost of goods sold is $200. But it is normal to do this for supplies like printer paper. You probably would not want to do this for trading stock, because you lose insight into your margin. You can still buy things and treat them as an immediate expense. Note that you don't have to use a "cost of goods sold" method for everything in your business. That is, it needs to make reports called "Balance Sheet" and "Profit and Loss" (also known as "Income Statement"), and it has to have an "inventory" account.

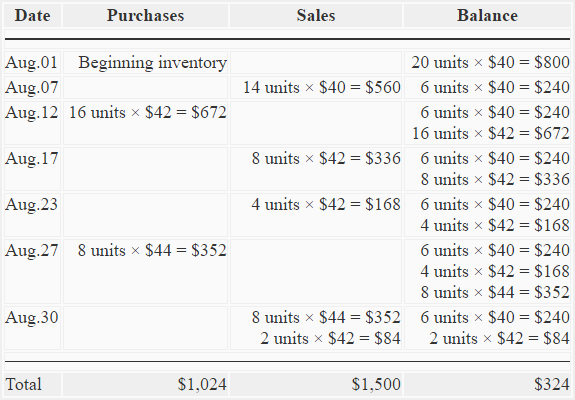

Since inventory doesn't become an expense until you sell it, we keep unsold inventory in an asset account called "inventory". The true economic cost is the actual replacement cost, but it is impractical to assess this in most cases, so we use approximations of the replacement cost, such as the actual cost we paid for the item we are selling, or the average cost we paid for all of our stock of that item.

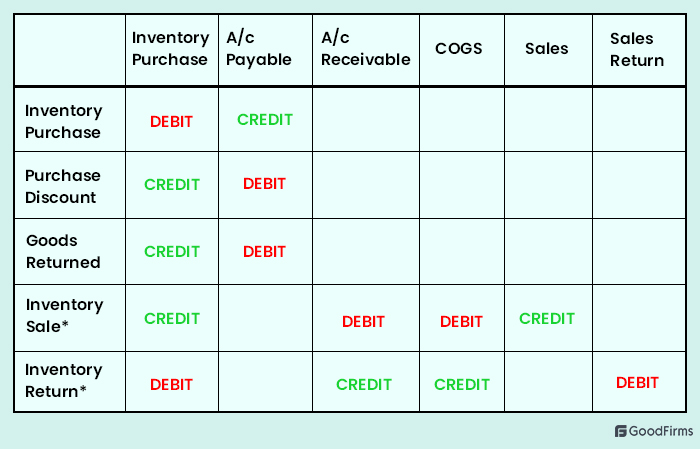

What cost? You incur the cost of replacing the stock, the instant you ship. Under the Perpetual Inventory system, you record each movement of stock. The only benefit of the Periodic method is less record keeping, a significant advantage before cheap computers. Between counts, you don't have a record of stock, so under the periodic inventory system, you don't record what you sold to whom. The alternative, the Periodic Inventory System, relies on periodic (usually monthly) inventory counts. "Constantly Correct Inventory" system may be better. The Perpetual Inventory System is 'perpetual' because it always (perpetually) tracks movements of stock the instant they happen. You'll make better pricing, discounting and marketing decisions. Rather, it is calculated using a lump sum at the end of the interval when the count is conducted.The Perpetual Inventory System is superior to the Periodic Inventory System: it provides gross margin of each invoice line and margins for each customer. COGS Accounting: There are no continual entries under the COGS account associated with periodic inventory systems.Periodic systems require physical counts and can often be cumbersome, especially if there are any recounts that need to be done. That's because everything is done electronically.

Perpetual inventory software#

Perpetual inventory manual#

Periodic systems, though, require manual recording.

Perpetual inventory update#

Recording Methods: Perpetual systems use computers and software that automatically update a company's ledgers with information about products that are sold and the remaining inventory.As such, they use occasional physical counts to measure their inventory and the cost of goods sold (COGS). The periodic inventory system is often used by smaller businesses that have easy-to-manage inventory and may not have a lot of money or the opportunity to implement computerized systems into their workflow. There is a greater margin of error with the periodic system as opposed to the perpetual system because it relies on a physical count.Businesses with larger inventories, high sales volumes, and multiple retail outlets need perpetual inventory systems.Periodic inventory accounting systems are better suited to small businesses that have easy-to-manage inventories or those with low sales volumes.The perpetual system keeps track of inventory balances continuously, with updates made automatically whenever a product is received or sold.The periodic inventory system uses an occasional physical count to measure the level of inventory and the cost of goods sold.

0 kommentar(er)

0 kommentar(er)